If you’re starting a nonprofit and researching how to get 501(c)(3) status, you’ve probably come across two options: Form 1023 and Form 1023-EZ. At first glance, the choice seems simple. If your organization expects to raise less than $50,000 per year for its first three years, the IRS encourages you to use the shorter, easier EZ form.

But what they don’t tell you is this: Form 1023-EZ may only give you temporary nonprofit status, and that can cause serious problems down the line for you, your organization, and your donors. To understand why, you need to look beyond the surface-level instructions and dig into the risks the IRS doesn’t advertise.

What Is Form 1023-EZ?

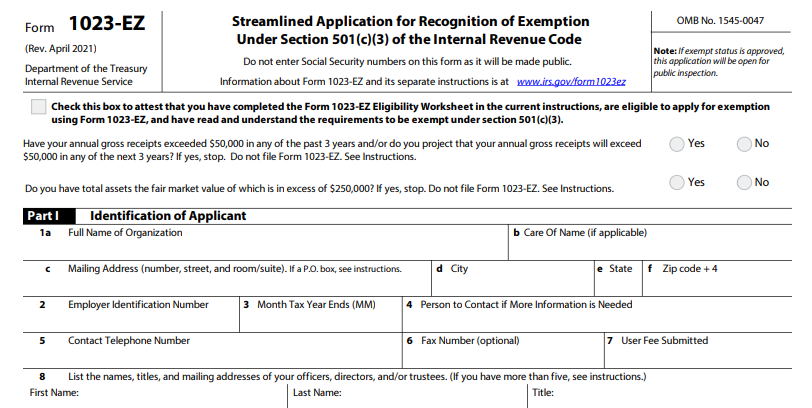

Form 1023-EZ is the streamlined version of the IRS application for tax-exempt status. It’s significantly shorter than the traditional Form 1023 and doesn’t require you to submit your founding documents—like bylaws or articles of incorporation—for IRS review. Instead of reviewing what you’ve written, the IRS simply accepts your attestations that everything is in proper legal order. That might sound efficient, but it opens up a major legal loophole that can jeopardize your nonprofit’s credibility and tax-exempt status if you get even one detail wrong.

The Political Backstory Behind Form 1023-EZ

The IRS introduced Form 1023-EZ in 2014, not as a strategic improvement, but as a crisis response. After being accused of unfairly delaying nonprofit applications from conservative groups, the agency faced intense public and political pressure to create a faster approval process. Rather than streamlining the existing Form 1023, the IRS created an entirely new shortcut: Form 1023-EZ.

In this rush to patch a political problem, the IRS quietly removed one of the most important checks in the application process—document review. Nonprofits were no longer required to show the IRS their governing documents; they simply had to promise that their documents met all requirements. It didn’t take long for problems to emerge. The Taxpayer Advocate Service submitted a series of fake 1023-EZ applications to test the system, and found that nine out of ten were approved—even when the organizations didn’t actually meet the legal standards.

Why 1023-EZ Puts Your Nonprofit at Risk

The key issue with Form 1023-EZ is that your approval letter from the IRS doesn’t mean what you think it means. Because the IRS never looks at your actual documents, they are relying entirely on your word. If your documents don’t perfectly match what you claimed on the form—even by accident—your 501(c)(3) status is on shaky ground. The IRS quietly issued guidance in the Internal Revenue Manual stating that if your founding documents don’t align with your attestations, then your determination letter is effectively invalid.

“A determination letter issued to an organization that submitted a request in accordance

with this revenue procedure may not be relied upon by the organization submitting the

request if it was based on any omission or inaccurate material information submitted by

the organization. Inaccurate material information includes an incorrect representation or

attestation as to the organization’s organizational documents, the organization’s exempt

purpose, the organization’s conduct of prohibited and restricted activities, or the

organization’s eligibility to file Form 1023-EZ.”

-Rec. Proc. 2023-5, Section 11.

In other words, even if you got a letter saying your nonprofit is approved, it likely won’t hold up if your organization were ever audited. Now, the letter looks the exact same as the letter that a nonprofit that filed Form 1023 would get. Except it is provisional, instead of permanent.

This makes Form 1023-EZ a temporary status, if you did everything right, than a permanent one. If the IRS audits your organization and finds inconsistencies, they have multiple remedies available—and none of them are good for your mission.

Common Mistakes When Filing Form 1023 EZ

Form 1023 EZ is not easy to avoid mistakes with, either. The most common mistake is putting the two required clauses, your purpose and dissolution clause, in your organization’s bylaws instead of your organization’s founding documents. This makes your nonprofit illegal from day one, and it has been present in approximately 75% of the self-filed applications we’ve reviewed.

The second most common mistake is to erroneously declare that your organization does not intend to raise more than $50,000 in revenue in its first three years – while forgetting that in-kind donations (i.e. donations of stuff) count. These are just two of the traps awaiting unwary, and genuinely good hearted nonprofit founders, by using this hastily created alternative to Form 1023.

What Can Happen If the IRS Audits Your Nonprofit

If you filed Form 1023-EZ and your documents don’t match the form’s requirements, the IRS can:

-

- Retroactively revoke your nonprofit status, all the way back to your date of incorporation—meaning your donors may have to amend their tax returns and pay back any deductions they claimed.

-

- Revoke your nonprofit status going forward, putting at risk any grants, contracts, or donor relationships that depend on your tax-exempt status.

-

- Issue a letter requiring you to fix your documents, which sounds simple—but because you signed the form under penalty of perjury, any inaccuracies may expose you to felony charges, even if unintentional.

Why You Should File the Full Form 1023 Instead

Filing the full Form 1023 may be more work, but it gives your nonprofit the legal foundation it needs to grow. When you file the long form, the IRS actually reviews your founding documents and verifies that your organization qualifies as a 501(c)(3). That means your approval letter is based on fact, not just faith. It protects you, your donors, and your board from the risks of revocation or audit surprises down the line.

In contrast, Form 1023-EZ is only appropriate in very narrow situations. I only use it when I am personally managing the entire process, verifying every document myself, and working with a very small organization that is unlikely to grow past the $50,000/year threshold, such as a memorial fund. Even then, I proceed with caution. The shortcut just isn’t worth the risk for most founders.

Funders and Donors Don’t Trust 1023-EZ Filings

There’s another problem with 1023-EZ that too many founders overlook. More and more grantmakers, fiscal sponsors, and major donors now see it as a red flag. Because the form skips any kind of document review, it signals that the organization may not have proper governance or legal infrastructure in place. In some cases, funders won’t even consider organizations that filed using Form 1023-EZ. It’s not just a legal shortcut—it’s a reputational liability.

If you want your nonprofit to be taken seriously by foundations, government agencies, or corporate partners, the full Form 1023 is a far better option. It shows you’re serious about compliance, sustainability, and proper oversight from the beginning.

Already Filed 1023-EZ? Here’s What You Can Do

If you already filed Form 1023-EZ, you’re not doomed—but you do need to take action. Start by reviewing your bylaws, articles of incorporation, and purpose statements. Make sure they meet all IRS requirements exactly and reflect what you attested to in your application. If anything is out of alignment, amend your documents and consider submitting a voluntary correction before an audit finds the error. Better to get ahead of it now than risk revocation later.

Final Thoughts: Don’t Take a Shortcut That Could Cost You Everything

Starting a nonprofit is no small task. It takes vision, courage, and a commitment to serving others. If you’re willing to do that work, don’t cut corners when it comes to your legal status. The EZ form might look easier, but in reality, it often leads to confusion, legal risk, and reputational harm.

Unless you’re working with a seasoned expert who understands the law and has reviewed every single document, do not file Form 1023-EZ. File the long form. Even if you don’t work with an expert, the IRS reviews your long form submission and you can rely on whatever response you get once you’re approved. Get real, verified tax-exempt status that your donors, board, and partners can trust. You deserve a solid foundation—and your mission does too.

If you want a team that can file your nonprofit professionally, and quickly, book a call with us. We’ve filed nonprofits large and small – and use the expedited filing process to get your application approved quickly, without taking the risks of the 1023 EZ form. Above all else- don’t put your mission at risk to save some time and a few bucks. The work nonprofits do is too important for that.